APRIL/MAY 2015

THE BERNARDS-RIDGE CONNECTION

PAGE 85

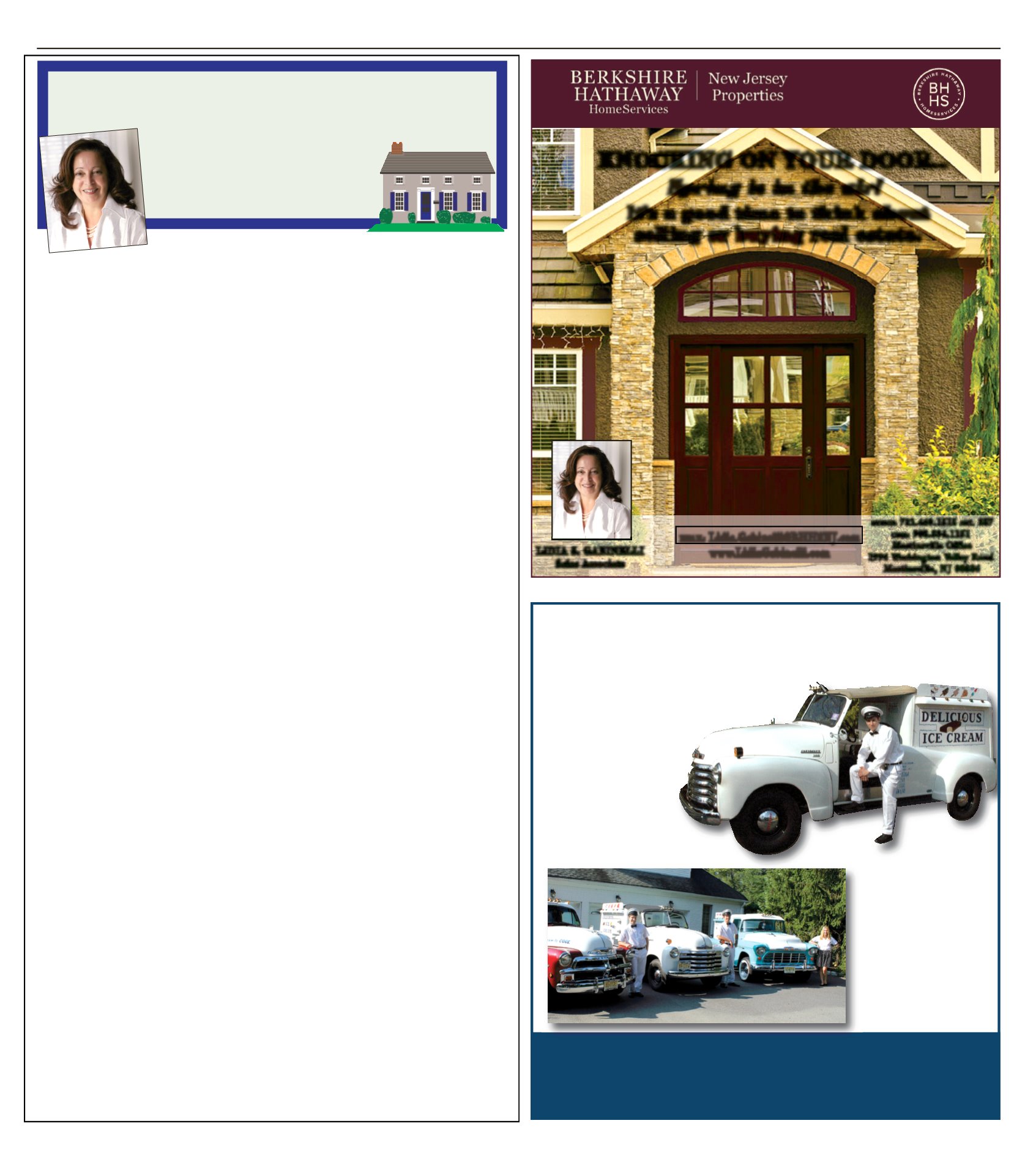

By: Lidia S. Gabinelli, Sales Associate Berkshire Hathaway HomeServices New Jersey Properties With mortgages and interest rates in constant flux, choosing the “right” or “best” mortgage can prove challenging. Although lenders and banks offer a variety of mortgages, most people really want to know how to obtain the lowest interest rate and maximize their ability to save the most money over time. Here are some facts and pointers to stay in the know. The two most common mort- gages are conventional, fixed-rate mortgages and adjustable-rate mortgages (ARMs). A convention- al, fixed-rate mortgage charges a set rate of interest that does not change throughout the life of the loan. The payment remains the same, which provides ease and efficiency for budgeting purpos- es. The main advantage of a fixed rate loan is that the borrower is protected from sudden and potentially significant increases in monthly mortgage payments should interest rates rise. Also advantageous is the fact that fixed rate mortgages are cus- tomized to fit your individual financial situation. The downside to a fixed-rate mortgage, howev- er, is that homeowners are bound to wherever the interest rates are at the time of their search for a new home. This is especially prob- lematic when interest rates are high. Higher interest rates mean a fixed-rate mortgage is more diffi- cult to afford, and therefore more difficult to qualify. With adjustable-rate mort- gages (ARM), the interest rate on a given loan varies over time. The initial interest rate on an ARM is set below the market rate on a comparable fixed-rate loan, then the rate rises as time goes on. ARMs are attractive because they offer low initial payments, enabling the borrower to qualify for a larger loan. Also, in a falling interest rate environment, ARMs allow the borrower to enjoy lower interest rates (and lower mort- gage payments) without the need to refinance. On the downside, a mortgagor’s monthly payment will likely change frequently over the life of the loan. If a mortgagor takes on a large loan, that mort- gagor may face a disproportion- ate increase in a given mortgage payment once interest rates rise. It is important to note that when deciding what mortgage is best for you, timing is crucial. For instance, when interest rates are high, or if a buyer does not plan to live in a particular house for very long, an ARM mortgage is a more sound option. On the other hand, when interest rates are low, locking in a fixed-rate mortgage would be ideal. Choosing your loan carefully could help you save a great deal of money over time, so take the time to consider all factors. Contact me for more details on mortgages or refinanc- ing from an affiliate lender that can save you money! If you are thinking of selling or buying, call me to take advantage of my recipe and tips for your next more! Oh by the way...if you know of someone that would appre- ciate my services, please con- tact me, I will be happy to help! What’s Cooking with Lidia: EASY MONEY! KNOCKING ON YOUR DOOR... Spring is in the air! It’s a good time to think about selling or buying real estate. EMAIL: Lidia.Gabinelli@BHHSNJ.com www.LidiaGabinelli.com LIDIA S. GABINELLI Sales Associate OFFICE: 732.469.1515 ext. 357 CELL: 908.334.1151 Martinsville Office 1996 Washington Valley Road Martinsville, NJ 08836 MAKE YOUR NEXT PARTY A CLASSIC WITH Bring a delicious taste of the good old days to your next event with our fully restored and fully stocked 1950s Ice Cream Trucks with uniformed driver. • Children/Adult Birthday Parties • Corporate Events & Picnics • Marketing Events • Fundraisers • School Events • Bar/Bat Mitzvahs • Weddings • Graduations and much more! DELICIOUS ICE CREAM 908-766-0468 www.deliciousicecreamllc.com www.theconnectionsnj.com