PAGE 30

THE WARREN-WATCHUNG CONNECTION

JUNE/JULY/AUGUST 2015

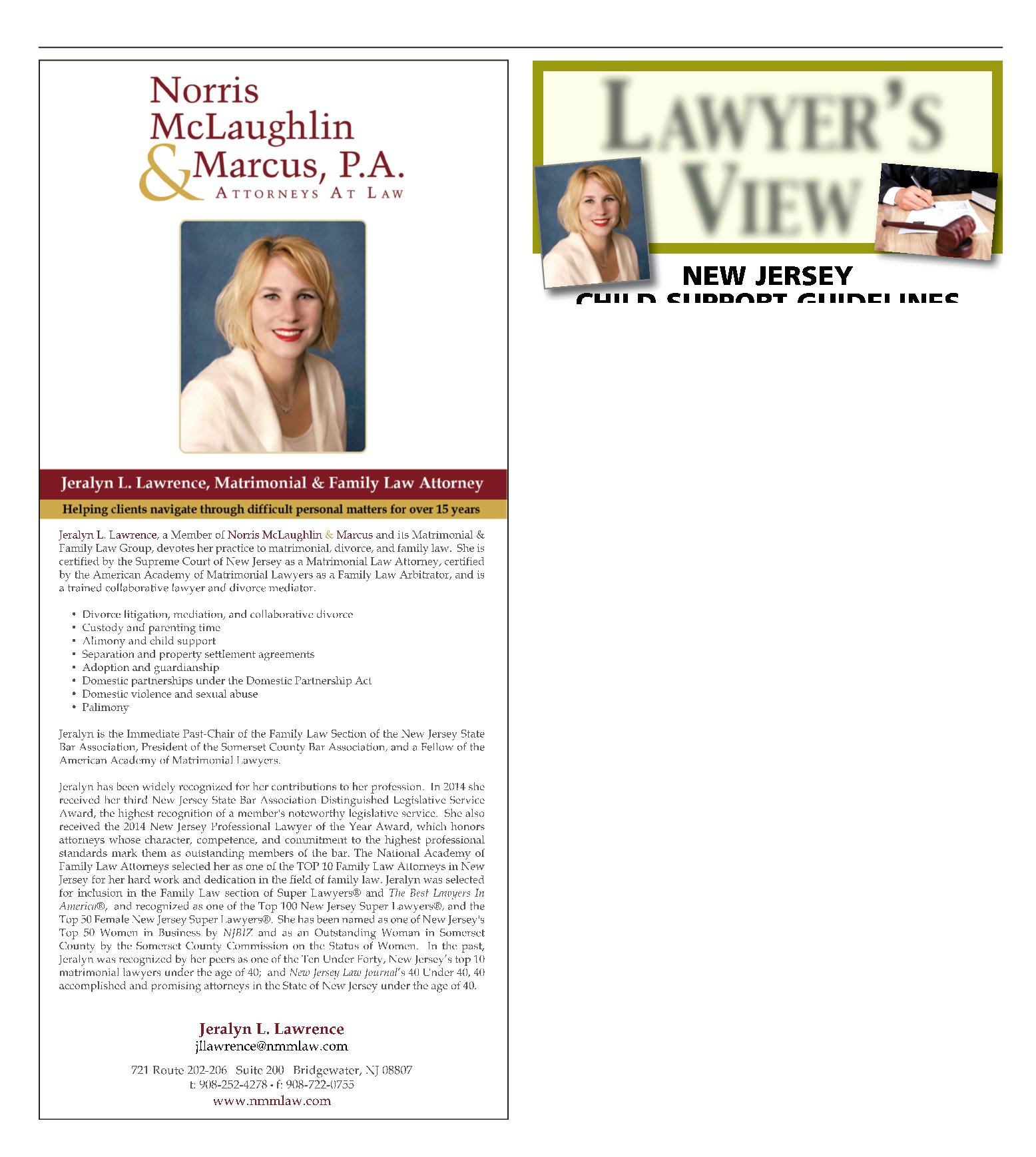

In New Jersey, in most cases in which child support is an issue, the child support award is calculated using Child Support Guidelines. Our law provides that the Guidelines must be used as a rebuttable presumption to establish and modify all child support orders. A rebuttable presumption means that an award pursuant to a Guideline’s calculation is assumed to be the correct amount of child sup- port unless a party proves to the court that circumstances exist that make the calculation inappropriate in a particular case. A court can disre- gard or adjust a Guidelines-based award if good cause is shown. Practically speaking, however, despite being labeled a rebuttable presumption, most judges use the Child Support Guidelines most of the time in establishing or modifying child support. The main premise of the Child Sup- port Guidelines is that child support is a continuous duty of both parents, and children are entitled to share in the current income of both parents. Accordingly, child support is based on the combined net income of both parents. The Guidelines provide for a weekly sum due for child support, taking into consideration the parties’ income and the number of children involved. Items included in a child support award include housing expenses (e.g., mortgage interest payments, property taxes, expenses for vacation homes, home repairs, computers, luggage), food (e.g., all food and non-alcoholic beverages purchased for home consumption or purchased away from home, tips, school meals), clothing (e.g., all children’s clothing, footware (except special footware for sports), diapers, dry cleaning, laundry, watches and jewelry), trans- portation (e.g., car payments, gas, oil, insurance, maintenance and repairs), unreimbursed health expens- es up to $250 per child per year, entertainment (e.g., admissions to sports, lessons, instructions, movie rentals, pets, video games) and lastly, miscellaneous items (e.g., hair care, shaving, cosmetic items). Items that may be added to a child support award include net work- related child care expenses, pre- dictable and recurring unreimbursed medical expenses (e.g., braces), and other expenses approved by the court (e.g., private school, special needs of gifted or disabled children, and extraordinary extracurricular activity expenses, such as horseback riding lessons). Before child support can be calculat- ed, the parties must first have resolved alimony and parenting time for the non-custodial parent, as they are rele- vant in a child support calculation. Because child support is based on the income of the parties, legal issues often arise as to what income is to be utilized for each party. Sometimes a parent is unemployed or underem- ployed or has irregular or sporadic income. Sometimes defining income can become a project in itself. For W- 2 wage earners, however, the Guide- lines are relatively simple. In any case, though, because there are so many considerations and factors upon which child support is based, be sure to speak to an attorney who special- izes in family/divorce law and has experience utilizing the Guidelines, so they can walk you through a child support calculation and ensure the correct amount is being paid or received. NEW JERSEY CHILD SUPPORT GUIDELINES By: Jeralyn L. Lawrence, Esq. Norris McLaughlin & Marcus, P.A. www.theconnectionsnj.com